Top 5 Financial Literacy Articles

If you prefer to read, here’s the list of the top five personal finance and financial literacy articles on Money Playschool over the year. Read or re-read them again!

Top 5 Personal Finance and Financial Literacy Video Content

1) What to look out for when getting a mortgage or home loan from banks?

“Which bank offers the lowest interest rate for their mortgage or loans?” and “Is it a fixed or floating interest rate?” are two of the most obvious and often asked questions by people while researching home loans from banks. However, they should not be the only criteria.

Adrian Jefferson, a veteran in the mortgage industry with over 16 years of experience, shares a list of five features to look out for when getting a mortgage or home loan from banks, apart from interest rates and whether they are fixed or floating.

2) Is it yuu that I’m looking for?

Is yuu the “Best Rewards Club Ever!”? yuu Rewards Club is in Singapore. Here’s what it is about.

“The yuu Rewards Club is a free and easy-to-use platform that unites some of the nation’s most popular brands, offering consumers an effortless way to earn rewards on their everyday purchases.”

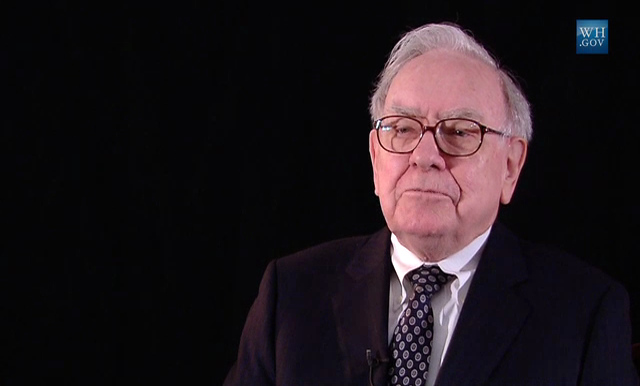

3) Three lessons from Warren Buffett’s 2022 Berkshire Hathaway shareholder letter

Warren E. Buffett is one of the most successful investors globally. He has a net worth of over $116 billion as of May 2022, making him the world’s sixth-wealthiest person.

He is also the CEO and Chairman of the Board of Berkshire Hathaway, an American multinational conglomerate holding company headquartered in Omaha, Nebraska, United States.

We take a look at Warren Buffett’s 2022 Berkshire Hathaway shareholder letter. Here are three lessons that stood out to us.

4) Book Review: Principles for Dealing with the Changing World Order – Ray Dalio

“Principles for Dealing with the Changing World Order: Why Nations Succeed and Fail” is authored by legendary investor Ray Dalio. Ray, the author of the #1 New York Times bestseller Principles, has spent half a century studying global economies and markets.

Principles for Dealing with the Changing World Order examines history’s most turbulent economic and political periods to reveal why the times ahead will likely be radically different from those we’ve experienced in our lifetimes—and to offer practical advice on how to navigate them well.

John Sim, Certified Financial Planner and a member of the Financial Planning Association of Singapore (FPAS), shares his thoughts on the book in this book review and summary.

5) MDRT President: MDRT members set the global financial services industry standard

2022 President of MDRT Randy L. Scritchfield, CFP, LUTCF, shares with Money Playschool what differentiates a financial adviser who is an MDRT member from one who is not, what it means when you have an MDRT member as your adviser, why MDRT is not about sales targets, and what MDRT is doing for the community through MDRT Foundation.

![[ID: PwLgIhjWaNw] Youtube Automatic](https://images.moneyplayschool.com/uploads/2023/01/03134417/id-pwlgihjwanw-youtube-automatic-60x60.jpg)

![[ID: tsOG4HOp9kw] Youtube Automatic](https://images.moneyplayschool.com/uploads/2023/02/03092000/id-tsog4hop9kw-youtube-automatic-60x60.jpg)

![[ID: 7zTVgRP6rFc] Youtube Automatic](https://images.moneyplayschool.com/uploads/2024/06/04100045/id-7ztvgrp6rfc-youtube-automatic-236x133.jpg)

![[ID: HWeGiA8HKlc] Youtube Automatic](https://images.moneyplayschool.com/uploads/2023/11/16081020/id-hwegia8hklc-youtube-automatic-236x133.jpg)

![[ID: igssw0tTUmE] Youtube Automatic](https://images.moneyplayschool.com/uploads/2023/11/16081022/id-igssw0ttume-youtube-automatic-236x133.jpg)

![[ID: j0-Lys2BEwE] Youtube Automatic](https://images.moneyplayschool.com/uploads/2023/02/13092713/id-j0-lys2bewe-youtube-automatic-236x133.jpg)

![[ID: PwLgIhjWaNw] Youtube Automatic](https://images.moneyplayschool.com/uploads/2023/01/03134417/id-pwlgihjwanw-youtube-automatic-236x133.jpg)

![[ID: 4uIXKO0dEa8] Youtube Automatic](https://images.moneyplayschool.com/uploads/2022/10/25160153/id-4uixko0dea8-youtube-automatic-236x133.jpg)