Thailand: Seasonality of Sales in the Insurance Market

Seasonality Lessons from Life Insurance Sales in Thailand

The article covers the period January 2023 through to August 2025, so it is a good length of time to consider trends – spikes and flat periods of sales. When you read the article you will see I have drawn some conclusions, but the report needs a lot of input from you to make it more valuable.

You will see a constant request for you to challenge my thoughts and to offer your opinions and ideas to explain the graphs more fully.

Please read, react and most importantly comment with your thoughts on the topic. After getting your feedback I will rewrite the report to include your thoughts. Please treat the article as a learning tool for us all. Thank you in anticipation of your comments.

Understanding Seasonality in Insurance Agency Sales

Explore the seasonality of sales across Thailand’s insurance market. Learn how agency, bank, broker, and digital channels perform across First Year Premium (FYP), Single Premium (SP), and New Business Issued (NBI). Discover insights on product trends, leadership in insurance, and the evolving behavior of insurance distribution channels.

By Channel

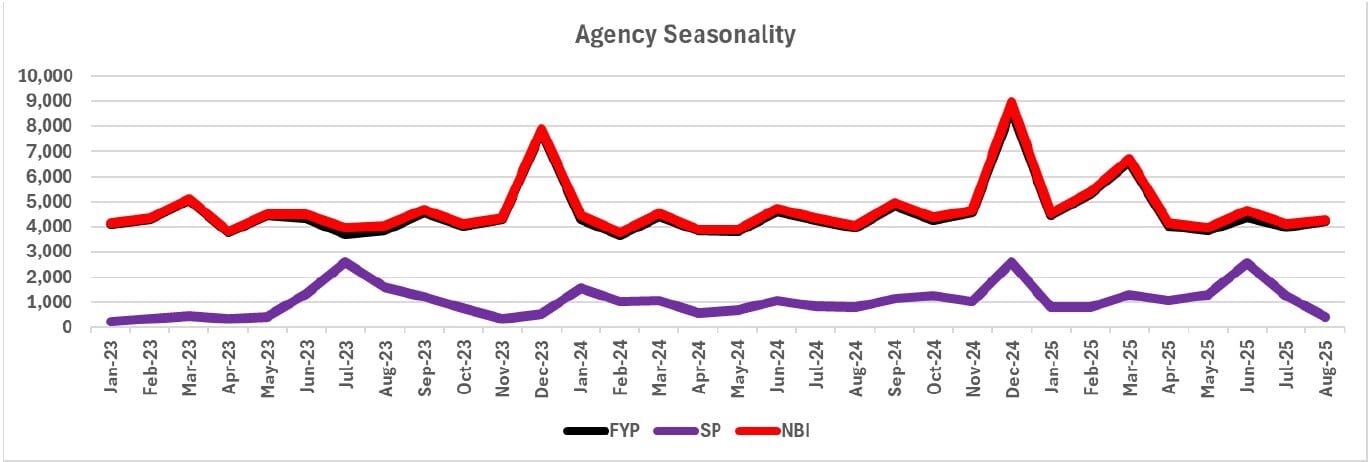

Agency

What do I see?

- Agency NBI is 45.3% of the total NBI for the Industry for the months reviewed.

- Major spike at Year-end which will be due to annual bonuses for the Agency Channel. The three months ending with December exceed the Agency Market Share with December well above the average at 56% consistently.

- A smaller spike each quarter, which suggests only some companies also have a quarterly bonus, but those that do create minor spikes. Others should consider a quarterly bonus. Or perhaps you have not found the right process to encourage Agents to peak for your quarterly bonus!

- FYP and NBI are very similar in shape showing that NBI formula favors FYP as you will see in most graphs in this article.

- Single Premium only plays a minor role in Agency sales. Could it do more?

- Are you ready for the seasonal chase to write volumes of Agency business before Year end?

What do you see? Please challenge my thoughts with your experience by commenting on this post on LinkedIn. That’s how we all learn.

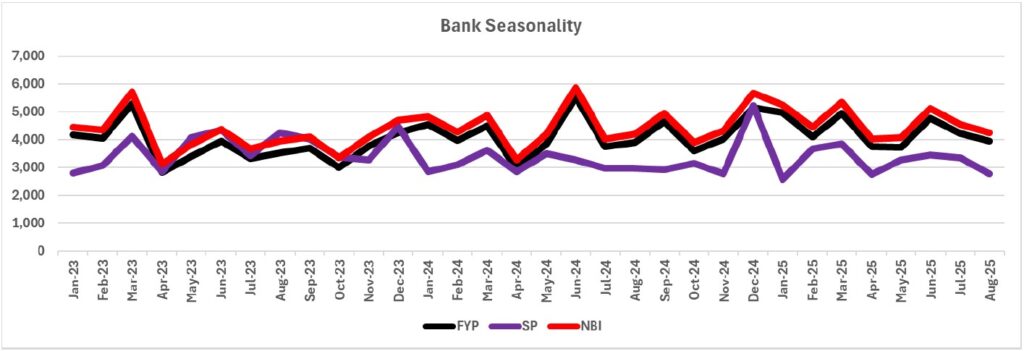

Bank

What do I see?

- Bank NBI is 42.6% of the total NBI for the Industry for the months reviewed.

- No major spikes at Year-end which I would expect to see as both the Insurance Company and Bank will be seeking to close the business for the year!

- There are some minor spikes each quarter which might reflect the Bank’s need to publish quarterly results for their shareholders and to give customers confidence.

- There is a consistent and significant flow of Single premium business all year, most likely from the Bank’s sales of Home Loan protection. Are there other single premiums sold by the Banks – Unit Linked, etc .?

- How is your business plan with the Bank working out this year?

What do you see? Please challenge my thoughts with your experience by commenting on this post on LinkedIn. That’s how we all learn.

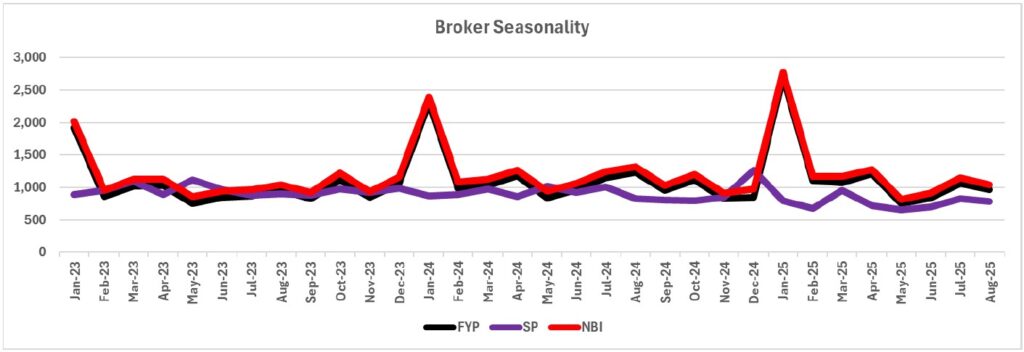

Broker and AD Channel

What do I see?

- Broker/AD NBI is 11.5% of the total NBI for the Industry for the months reviewed.

- Massive spikes every January which I would expect to reflect the sales of Group EB to Employers who like to use it as a positive start to the year by offering their teams a new benefit.

- The other important news is the consistent monthly flow of new sales across all modes of premium especially Single premiums. I am not sure why – can anyone tell me please?

- Are you ready for the spike in January 2026 – your work should be underway NOW. January seems to generate between 15% and 17% of total Broker sales in a year.

What do you see? Please challenge my thoughts with your experience by commenting on this post on LinkedIn. That’s how we all learn.

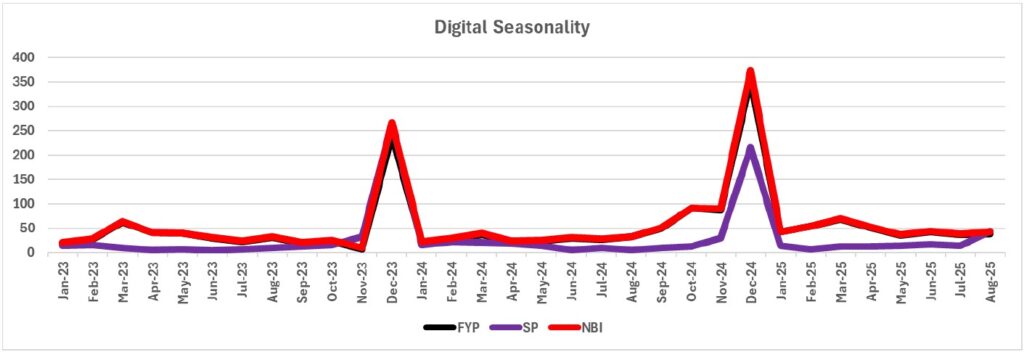

Digital

What do I see?

- Digital NBI is only 0.5% of the total NBI for the Industry for the months reviewed.

- Massive spikes every December which I would expect to reflect the sales of products designed to maximize the customer’s Life Insurance Tax relief.

- It is an important emerging market that will start to mature within 10 years so learn important lessons today.

What do you see? Please challenge my thoughts with your experience by commenting on this post on LinkedIn. That’s how we all learn.

By Product

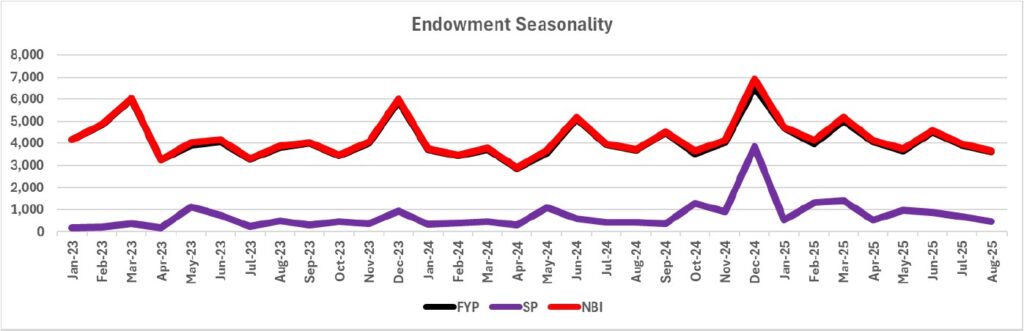

Endowment

What do I see?

- Endowment Sales rank #1 for NBI at 40.8% of the total NBI for the Industry for the months reviewed. Thai customers prefer saving to other products. Are they overlooking their other important needs?

- Spikes occur every December, which I would suggest is the customer is busy maximizing their Life Insurance Tax relief and Distributors maxing out their Year-end results.

- Small spikes at quarter end with probably suggests Agents are using this product to chase their quarterly bonuses – if available in your company.

- Single premium Endowment has a small volume – perhaps you are offering the mature 3 years pay 2 years product to get NBI credit at 100%. The 3/2 is not worth the financial challenges it creates with your IFRS17.

What do you see? Please challenge my thoughts with your experience by commenting on this post on LinkedIn. That’s how we all learn.

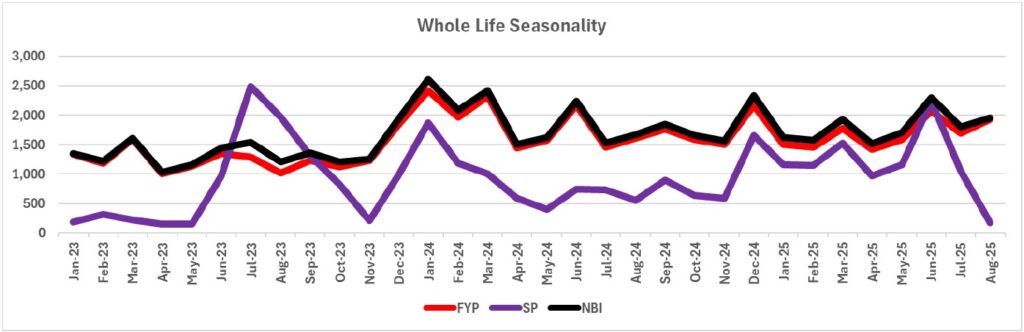

Whole Life

What do I see?

- Whole Life Sales ranks #2 for NBI at 16.3% of the total NBI for the Industry for the months reviewed. Is the product being sold as part of a financial planning program with the customer or being pushed for higher commission and because the company is chasing VNB margin?

- Interesting spikes in single premium Whole Life. Can you share how these are positioned with customers? They look like short-term special offerings. I would love to hear your answers.

- Small spikes at quarter end with probably suggests Agents are using this product to chase their quarterly bonuses – if available in your company.

What do you see? Please challenge my thoughts with your experience by commenting on this post on LinkedIn. That’s how we all learn.

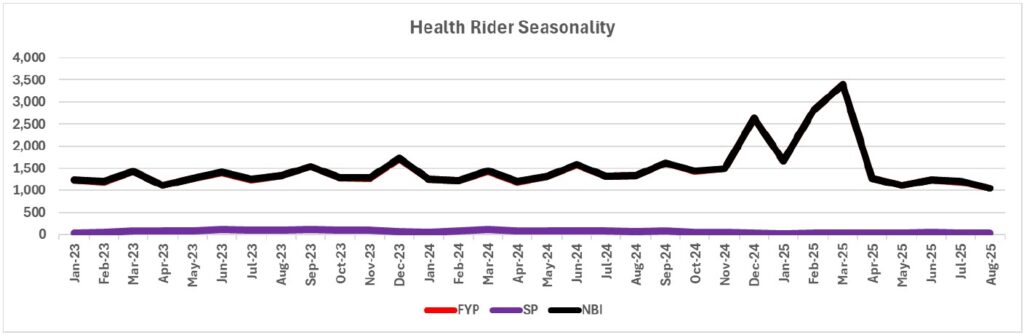

Health Riders

What do I see?

- Health Rider Sales ranks #3 for NBI at 14.4% of the total NBI for the Industry for the months reviewed. The seasonality looks very consistent until Q1 2025 when we had the “Fire Sales” of old products. Have you set up a plan to handle the risk of future litigation on claims?

- Single Premium sales are almost zero.

- Small spikes at quarter end with probably suggests Agents are using this product to chase their quarterly bonuses – if available in your company.

- Looks like sales are falling after the “fire sale.” Why?

What do you see? Please challenge my thoughts with your experience by commenting on this post on LinkedIn. That’s how we all learn.

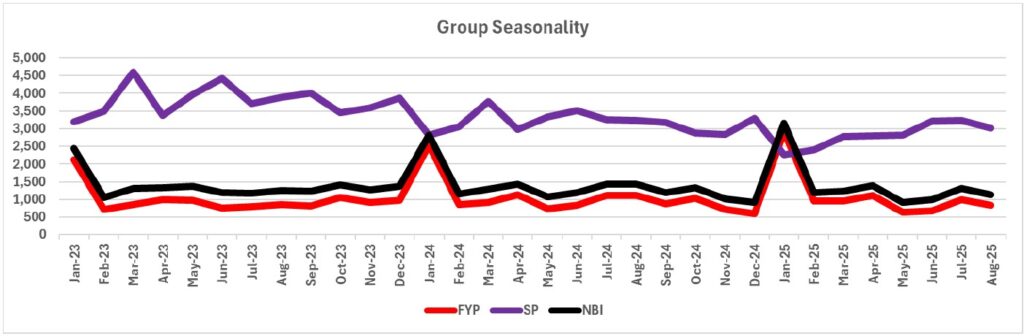

Group Sales (EB, Bank Loan Protection, etc.)

What do I see?

- Group Sales ranks #4 for NBI at 13.3% of the total NBI for the Industry for the months reviewed. The seasonality supports my view that many Group EB are initiated in January to allow Corporations to provide their employees with positive news at the start of the year.

- Single Premium sales are very important to this product group and probably represent Home Loan and other Loan protection offered though Banks to their customers base.

- Strong consistent market throughout the rest of the year.

- Are you getting ready for the January spike in Group EB? The preparatory work and pitching should be happening in Q4.

What do you see? Please challenge my thoughts with your experience by commenting on this post on LinkedIn. That’s how we all learn.

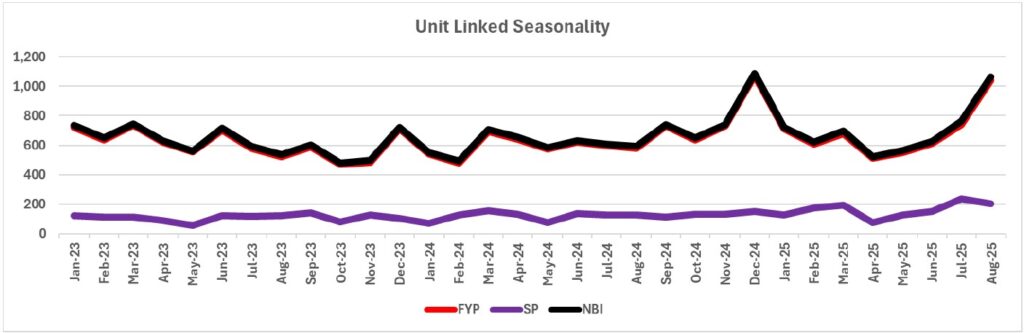

Unit Linked

What do I see?

- Unit Linked Sales ranks #5 for NBI at 6.4% of the total NBI for the Industry for the months reviewed. The seasonality suggests it is used at Year-End for tax purposes. Sales have risen in recent months. Are you on the Unit Linked Trail?

- Single Premium Unit Liked sales are smaller than I expected. Customers lost interest in the product due to design (it is a protection design rather than a savings design). I thought the HNW, financially more sophisticated customers, might “dip” into the market when they saw the right moment like they so with Bonds and Shares.

- Consistent market throughout the year.

- Unit Linked has not really taken its place higher in the rankings. There is market gap for a truly Savings oriented Plan to supplement the current Protection version – it would be new on the market.

- Risk warning: Unit Linked Plans are not for every customer. Make sure that you collaborate with the customer to identify their “Risk Tolerance” – using a series of questions around the customers opinions about risk and reward. For many customers traditional savings plans are right because they give important guarantees. Record the customers’ choices in writing and add them to their file.

What do you see? Please challenge my thoughts with your experience by commenting on this post on LinkedIn. That’s how we all learn.

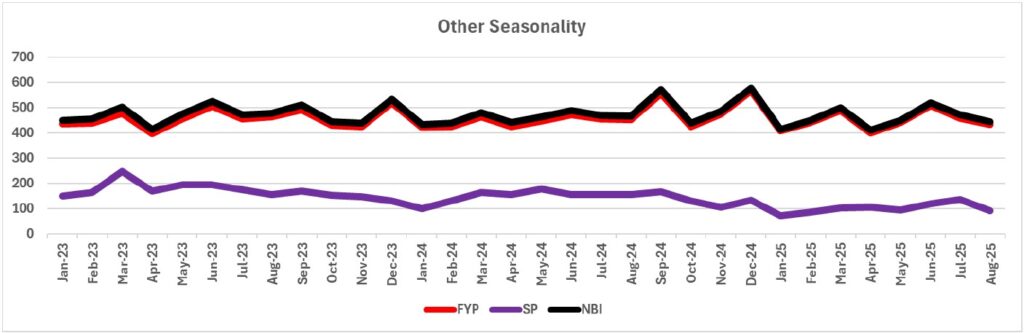

Other Products

What do I see?

- Other Sales ranks #6 for NBI at 4.6% of the total NBI for the Industry for the months reviewed. The seasonality that the information I was given about this includes Group EB sold direct to Companies and Government Departments.

- Single Premium sales are consistent at around Bt 150,000 per month or 20% of FYP sales.

- Consistent market throughout the year.

- I am interested in your thoughts about what this market is.

What do you see? Please challenge my thoughts with your experience by commenting on this post on LinkedIn. That’s how we all learn.

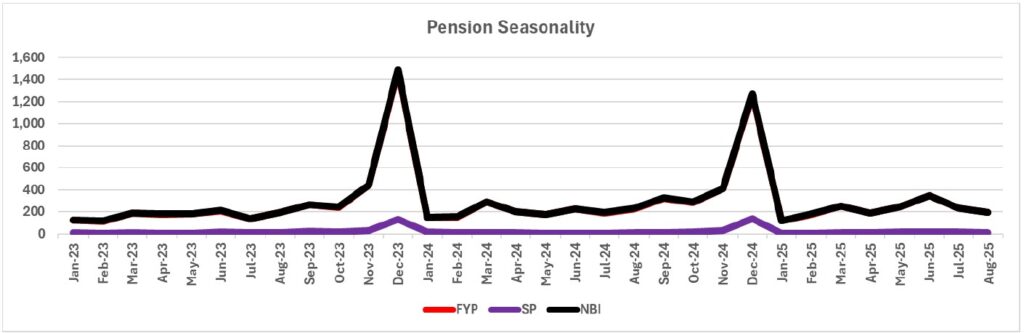

Pension

What do I see?

- Pension Sales ranks #7 for NBI at 2.9% of the total NBI for the Industry for the months reviewed.

- Single Premium sales are very low.

- The Year-End spikes tell us this is used for tax saving as a last resort.

- It surprises me that this product is not very popular in the total market. It should be attractive to the self-employed (there are many in Thailand) and to employees to bolster that their employer must do for them under current regulations (a redundancy payment at retirement).

- When employees leave a company they also get a redundancy payment – invest in SP Pension?

What do you see? Please challenge my thoughts with your experience by commenting on this post on LinkedIn. That’s how we all learn.

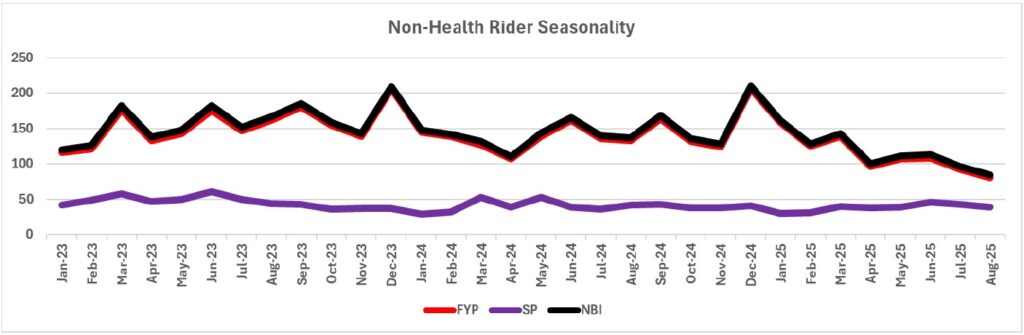

Non-Health Riders

What do I see?

- Non-Health Riders ranks #8 the lowest for NBI at 1.4% of the total NBI for the Industry for the months reviewed.

- Both Premium mode sales are very low. But do not let this discourage you as they offer

important benefits the customer might need – Waiver of Premiums Accidental Death Benefits, etc. - Sadly, the trend seems to be downwards.

What do you see? Please challenge my thoughts with your experience by commenting on this post on LinkedIn. That’s how we all learn.

The report includes many graphs some of which I have tried to explain, but we need help to better understand what might be happening and I hope you as a reader will have thoughts and opinions that will improve our understanding of each channel and each product. Please comment on LinkedIn space with what you know. Please help us all – me included.

Mike

October 25, 2025

Written by Michael Plaxton

Independent Consultant.

Former CEO of FWD Thailand, former CEO of Krungthai-AXA Life Insurance.

This is a Money Playschool x Michael Plaxton collaboration.

Find the original article here.

![[ID: o8GfGzEfsZI] Youtube Automatic](https://images.moneyplayschool.com/uploads/2025/11/14173318/id-o8gfgzefszi-youtube-automatic-60x60.jpg)

![Private: [ID: Era11cJS-ac] Youtube Automatic](https://images.moneyplayschool.com/uploads/2025/11/21103829/private-id-era11cjs-ac-youtube-a-60x60.jpg)

![Private: [ID: cgf4ii-_1aY] Youtube Automatic](https://images.moneyplayschool.com/uploads/2026/02/18110004/private-id-cgf4ii-1ay-youtube-au-236x133.jpg)

![Private: [ID: nUGCsB5mX54] Youtube Automatic](https://images.moneyplayschool.com/uploads/2026/02/17110004/private-id-nugcsb5mx54-youtube-a-236x133.jpg)

![Private: [ID: jzs9Qauu1EQ] Youtube Automatic](https://images.moneyplayschool.com/uploads/2026/02/16110004/private-id-jzs9qauu1eq-youtube-a-236x133.jpg)

![Private: [ID: IvNcm3y_mSw] Youtube Automatic](https://images.moneyplayschool.com/uploads/2026/02/15110004/private-id-ivncm3ymsw-youtube-au-236x133.jpg)

![Private: [ID: EU7T6XkwuOk] Youtube Automatic](https://images.moneyplayschool.com/uploads/2026/02/14110004/private-id-eu7t6xkwuok-youtube-a-236x133.jpg)

![Private: [ID: L8iLmI66Egw] Youtube Automatic](https://images.moneyplayschool.com/uploads/2026/02/13110004/private-id-l8ilmi66egw-youtube-a-236x133.jpg)