World Life Insurance Report: Why Consumers under 40 are skipping traditional life insurance

Even though 68% of adults under the age of 40 see life insurance as essential for a healthy financial future, current offerings do not align with their financial priorities, hindering adoption, accroding to the World Life Insurance Report 2026, conducted by the Capgemini Research Institute and LIMRA.

The report finds that young consumers seek near-term gratification through easy-to-access benefits throughout their life, which are often not included in a traditional life insurance policy. While some carriers offer these benefits, 1-in-4 consumers are still turning down life insurance due to confusing processes and complex jargon that make policies difficult to understand and use.

An industry in transition: a need to demonstrate relevance to next-gen policyholders

The life insurance industry is facing a critical challenge as its next generation of customers redefines their major life milestones. The Capgemini-LIMRA study reveals consumers under the age of 40 today are delaying or skipping the traditional triggers for purchasing life insurance: 63% have no immediate marriage plans and 84% of both single and married people have no immediate plans to have a child.

The report polled over 6,100 individuals aged 18-39 across 18 markets

The report, which polled over 6,100 individuals aged 18-39 across 18 markets, highlights a notable paradox as the great wealth transfer gets underway over the next 15-20 years. With millennials and Gen Z expecting an average inheritance of US$106,000 per person, life insurance remains an important destination for these funds. In fact, forty percent of under 40 adults rank life insurance and annuities as the third most important pillar for their inheritance investment plan, behind stocks and cash savings.

“As the next generation accumulates wealth and pursues a less traditional life path, their expectations around financial protection are evolving. The life insurance industry cannot rely solely on traditional death protection to sustain its future. Life insurers need to demonstrate value to include near-term gratification — delivering tangible benefits that customers can access during their lifetime,” said Samantha Chow, Global Leader for Life Insurance, Annuities and Benefits Sector at Capgemini.

She added: “Fortunately, life insurers can bridge this gap by deploying innovative products and articulating their value in ways that resonate with tomorrow’s policyholders.”

Revamping the life insurance value proposition for the Under-40s

Life insurers are beginning to recognize how the needs and expectations for the under-40 market differ from older customers. Global life insurance executives identify factors such as aging populations and rising longevity (64%), delayed life milestones (53%), and continued economic uncertainty (51%) as key drivers of their long-term strategies.

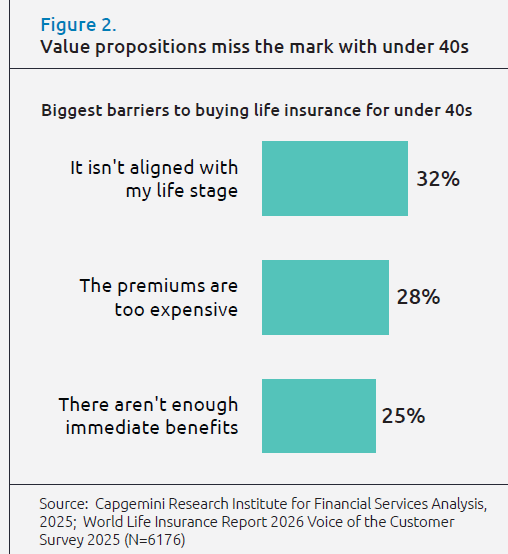

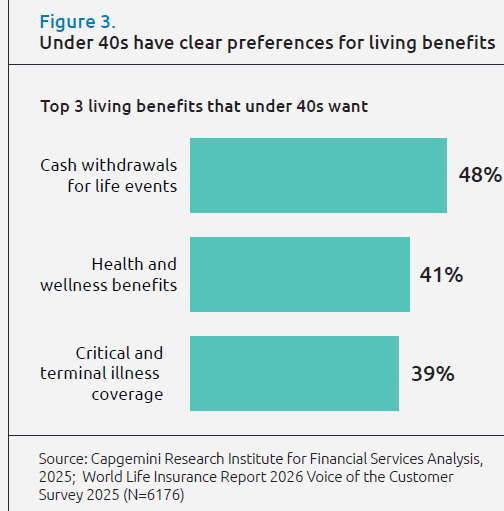

However, perceptions about life insurance remain a hurdle for carriers. When asked about barriers to purchasing life insurance, younger consumers cite a misalignment with their current stage in life (32%), high premium costs (28%), and lack of immediate benefits (25%). Instead, these younger adults demand easy access to ‘living benefits’ that support their changing life journeys, seeking everything from wellness rewards for healthy behaviors to coverage for fertility treatments.

“Carriers need a different playbook when marketing life insurance to the younger generations,” said Bryan Hodgens, Senior Vice President and Head of LIMRA Research. “Our joint research shows that the price misconceptions, coupled with competing financial priorities, positions life insurance at a disadvantage with younger adults. Carriers must not only demonstrate the accessibility and affordability of life insurance but also need to reimagine the product to address younger adults’ current financial priorities while adapting to meet their future financial goals as they age.”

Consumers also want life insurance that isn’t contingent on their current employer. Despite 44% of employees with a group policy seeking coverage that moves with them when they change jobs, only 19% of life insurers currently offer it. A complex conversion process limits portability and prevents many benefit providers from keeping long-term customers. Therefore, many consumers have no choice but to change policies when they switch jobs, even if they are happy with their previous coverage.

Technological capabilities are essential for under 40s

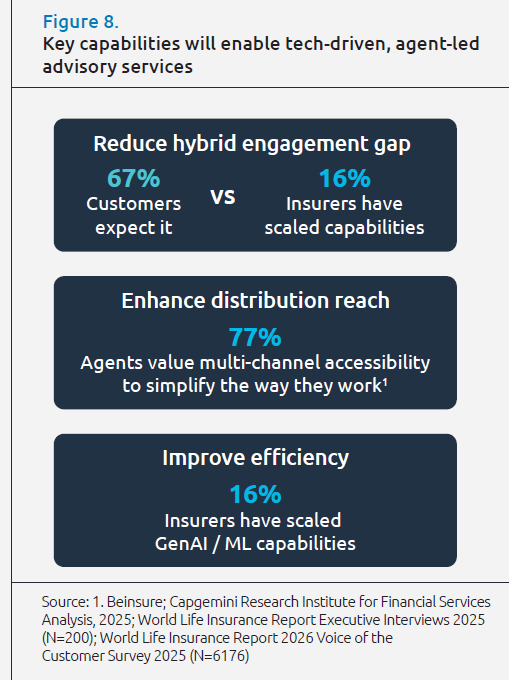

Delivering the living benefits and seamless experiences that younger consumers demand requires a richer value proposition, channel innovation, and a technological transformation. According to the report, 59% of under-40s want direct digital engagement, but just 31% of insurers surveyed offer the platforms to enable it. This shortfall is even more pronounced when it comes to advanced technologies, as 77% of consumers expect comprehensive, data-driven recommendations, but only 16% of insurers that participated in the survey provide them at scale, largely due to outdated legacy systems.

77% of consumers expect comprehensive, data-driven recommendations, but only 16% of insurers that participated in the survey provide them at scale, largely due to outdated legacy systems

To close this divide and win the next generation, the report recommends life insurers focus on three core pillars of transformation:

- Innovate the product: launch flexible solutions with living benefits at the core, simplifying underwriting and gamifying engagement to deliver tangible value across all life stages.

- Empower the advisor: equip agents with AI tools and customer insights for personalized guidance and modernize compensation models to attract the next generation of agents.

- Forge strategic ecosystem partnerships: embed life insurance into everyday experiences by seamlessly partnering with financial institutions, wellness companies, and HR platforms to deliver timely, contextual value.

Insurers that act decisively today will seize tomorrow’s growth opportunities, while maintaining the ongoing flexibility to refine their innovation strategies, go-to-market approaches, and technology infrastructures. Firms that act too slowly will face rising costs, stagnant growth, and a shrinking window of opportunity to engage younger consumers.

TL;DR

Why are under-40 consumers overlooking traditional life insurance?

Many under-40 consumers view traditional life insurance as outdated. They want near-term, tangible benefits, but current policies focus mainly on death protection. Complex jargon, high premiums, and confusing processes further discourage them from buying — even though 68% believe life insurance is essential for their financial future.

What do younger consumers want from life insurance?

Millennials and Gen Z want “living benefits” they can use during their lifetime — like wellness rewards, fertility coverage, and flexible access to funds. They also expect simple digital experiences, transparent pricing, and portable policies that aren’t tied to one employer or job change.

How can life insurers appeal to the under-40 market?

Insurers must offer flexible, benefit-rich products, empower advisors with AI-driven insights, and create seamless digital platforms. Embedding life insurance into everyday experiences through partnerships with wellness firms, financial institutions, and HR platforms can also help carriers stay relevant to younger consumers’ evolving lifestyles.

What role does technology play in life insurance for Gen Z and millennials?

Technology is critical. Under-40s expect digital onboarding, data-driven recommendations, and instant engagement. Yet only 31% of insurers offer robust digital platforms and just 16% provide personalised advice at scale. Modernising legacy systems is essential to win younger consumers and build long-term loyalty.

What is the research methodology for the World Life Insurance Report 2026?

The World Life Insurance Report 2026 draws on three primary sources: the 2025 Global Voice of the Customer Survey, the 2025 Global Insurance Executive Interviews, and the 2025 Global Macroeconomic Forecasts, developed in collaboration with a leading macro forecaster. This primary research includes insights from 22 markets: Australia, Belgium, Brazil, Canada, China, Colombia, Denmark, Finland, France, Germany, Hong Kong, India, Italy, Japan, Mexico, the Netherlands, Portugal, Singapore, Spain, Sweden, the United Kingdom, and the United States.

Editor’s Picks

![[ID: PTXqsUPFE4Q] Youtube Automatic](https://images.moneyplayschool.com/uploads/2025/09/17170341/id-ptxqsupfe4q-youtube-automatic-60x60.jpg)

![Private: [ID: cgf4ii-_1aY] Youtube Automatic](https://images.moneyplayschool.com/uploads/2026/02/18110004/private-id-cgf4ii-1ay-youtube-au-236x133.jpg)

![Private: [ID: nUGCsB5mX54] Youtube Automatic](https://images.moneyplayschool.com/uploads/2026/02/17110004/private-id-nugcsb5mx54-youtube-a-236x133.jpg)

![Private: [ID: jzs9Qauu1EQ] Youtube Automatic](https://images.moneyplayschool.com/uploads/2026/02/16110004/private-id-jzs9qauu1eq-youtube-a-236x133.jpg)

![Private: [ID: IvNcm3y_mSw] Youtube Automatic](https://images.moneyplayschool.com/uploads/2026/02/15110004/private-id-ivncm3ymsw-youtube-au-236x133.jpg)

![Private: [ID: EU7T6XkwuOk] Youtube Automatic](https://images.moneyplayschool.com/uploads/2026/02/14110004/private-id-eu7t6xkwuok-youtube-a-236x133.jpg)

![Private: [ID: L8iLmI66Egw] Youtube Automatic](https://images.moneyplayschool.com/uploads/2026/02/13110004/private-id-l8ilmi66egw-youtube-a-236x133.jpg)