Three lessons from Warren Buffett’s 2022 Berkshire Hathaway shareholder letter

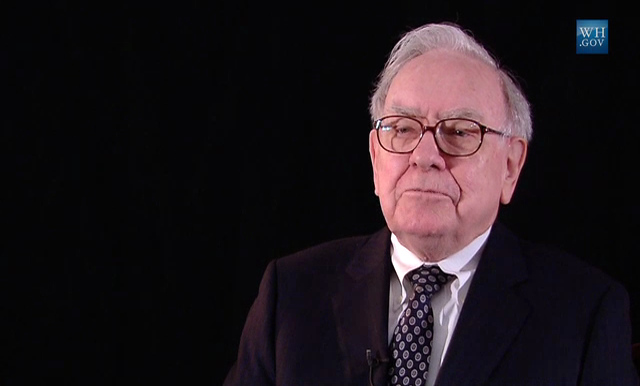

Warren E. Buffett is one of the most successful investors globally. He has a net worth of over $116 billion as of May 2022, making him the world’s sixth-wealthiest person.

He is also the CEO and Chairman of the Board of Berkshire Hathaway, an American multinational conglomerate holding company headquartered in Omaha, Nebraska, United States.

Every year, Berkshire Hathaway’s annual shareholder meeting and Warren Buffett’s annual shareholder letter are some of the most keenly watched in the world of finance and investing.

We take a look at Warren Buffett’s 2022 Berkshire Hathaway shareholder letter. Here are three lessons that stood out to us:

1. Clarify your thoughts with the orangutan effect

Did you know? Warren Buffett taught his first investing class 70 years ago. Since then, he has enjoyed working with students of all ages almost every year. He finally “retired” from that pursuit in 2018.

One of the reasons he enjoys teaching is because teaching, like writing, has helped Warren Buffett develop and clarify his thoughts.

Charlie Munger, Warren Buffett’s long-time business partner, calls the phenomenon the orangutan effect. If you sit down with an orangutan and carefully explain to it one of your cherished ideas, you may leave behind a puzzled primate, but will yourself exit thinking more clearly.

2. Seek employment as if you had no need for money

Speaking to university students, he has urged that they seek employment in:

(1) the field, and

(2) with the kind of people they would select,

if they had no need for money.

Warren Buffett acknowledges that economic realities may interfere with that kind of search. Even so, he urges the students never to give up the quest, for when they find that sort of job, they will no longer be “working.”

3. Invest in long-term business performance

Berkshire owns a wide variety of businesses, some in their entirety, some only in part.

Whatever the form of ownership in these businesses, Warren Buffet made it very clear that Berkshire Hathaway’s goal is to have meaningful investments in businesses with both durable economic advantages and a first-class CEO.

“Please note particularly that we own stocks based upon our expectations about their long-term business performance and not because we view them as vehicles for timely market moves,” he said.

“That point is crucial: Charlie and I are not stock-pickers; we are business-pickers.”

Warren Buffett

Bonus lesson from Warren Buffet’s Berkshire Hathaway 2022 annual shareholder letter

I know I said three lessons, but here’s a bonus one that gives the rest of us some comfort.

What did one of the most successful investors of all time and one of the richest men in the world say that provided such comfort?

Simply a sentence that Warren Buffett said:

“I make many mistakes.”

Warren Buffett

So if you make mistakes in life, career or investing, know that you are not alone.

You would love these investment-related content, too:

The best quotes and investment tips we love from Warren Buffett

How to create passive income to fund essential to luxury expenses

Eight Fundamentals of Investing

Check out our video content on Money Playschool YouTube Channel.

![Private: [ID: VxoMcyOHubg] Youtube Automatic](https://images.moneyplayschool.com/uploads/2026/01/09080004/private-id-vxomcyohubg-youtube-a-236x133.jpg)

![Private: [ID: jxdiOuDzkdU] Youtube Automatic](https://images.moneyplayschool.com/uploads/2026/01/08080005/private-id-jxdioudzkdu-youtube-a-236x133.jpg)

![Private: [ID: Lta8U_kDNNA] Youtube Automatic](https://images.moneyplayschool.com/uploads/2026/01/07180003/private-id-lta8ukdnna-youtube-au-236x133.jpg)

![Private: [ID: LzwlD4-5g8A] Youtube Automatic](https://images.moneyplayschool.com/uploads/2025/12/21130004/private-id-lzwld4-5g8a-youtube-a-236x133.jpg)

![Private: [ID: 3uKGhQSjkyU] Youtube Automatic](https://images.moneyplayschool.com/uploads/2025/12/19180005/private-id-3ukghqsjkyu-youtube-a-236x133.jpg)

![[ID: dF5uvHcxORM] Youtube Automatic](https://images.moneyplayschool.com/uploads/2025/11/14173320/id-df5uvhcxorm-youtube-automatic-236x133.jpg)