Agency Distribution in Thailand: A Leadership Wake-Up Call

A candid message for CEOs, RCEOs, and distribution leaders.

Over the past month, Michael Plaxton, Former CEO of FWD Thailand, former CEO of Krungthai-AXA Life Insurance, has shared a series of insights exploring the numbers and narratives shaping Thailand’s insurance distribution landscape. This latest piece turns the focus to agency distribution—but its implications go far beyond a single channel.

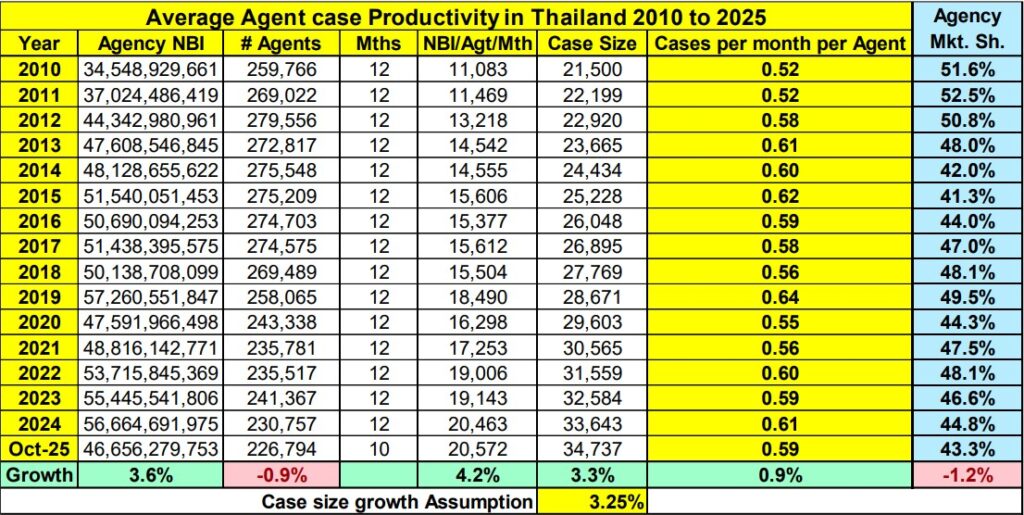

Thailand’s Life Agencies NO REAL CHANGE – BUT WHY?

After 55 years in the business as a business leader, I have to say to RCEOs, CEOs, CAOs

of ALL Life Companies working in Thailand – GET REAL AND STOP DELUDING

YOURSELVES. The numbers above say you are failing your Customers and your

Agents.

Agency, in its many forms, has been the bedrock of Life Insurance since the business began

centuries ago. In Western Countries the Agency business has become more professional

and still plays a significant role today. It is in Thailand too, though its market share and the

number of Agents have fallen over the last 15 years as other Distribution Channels grow

stronger – especially Bancassurance.

Are you happy with 3.6% growth for Agency? The whole market has grown 5.0% in

the same period. Thailand is no longer the “Asian Tiger” it was 2 decades ago. The table

suggests that the Agency growth has come from Customers being willing to pay more

each year.

THEREIN LIES THE REAL CHALLENGE. The strength of Agency has always been the

trusting relationship they have with their core customer base of “Friends and Family.”

Today’s customers are far more financially aware than they were even 15 years ago.

They deserve full professional Financial Planning Service from the Distributors.

But with case productivity of only 0.59 cases per month, I MUST CONCLUDE THEY ARE

NOT GETTING THIS HIGHER DELIVERY OF SATISFACTION.

Why? The typical Agent must be Part-time as they cannot provide for a family with this

meager level of sales each month. Consider my rationale:

- The average Agent only produces 1 case every 2 months!

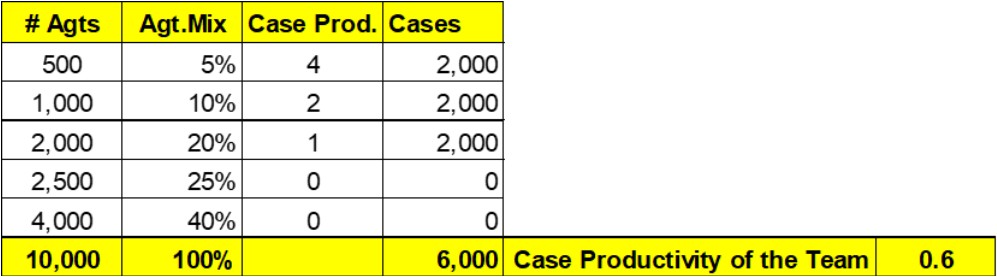

- It is worse than this because in a typical Agency setup there will be a mix of higher producers with lower producers each month. Look at the simple dynamic that there is good Agents and not so good Agents to arrive at the 0.59 cases per month.

In this simple model 65% of Agents have zero production. Overall, in the analysis

ends up close to the monthly case productivity of 0.59 cases per Agent.

Neither scenario is good for the Customer overall and certainly the RCEOs, CEOs, and

CAOs are fooling themselves with the better results of a few agents.

THE HARD TRUTH! CASE PRODUCTIVITY HAS NOT CHANGED OVER THE YEARS. I

can report that it was only 0.5 cases per month in 1995 when I first arrived in Asia.

So where is the problem? In the last month I have posted a number of articles about all the

Distribution Channels in Thailand – go read them there are at least 5 devoted to Agency

improvement STRATEGIES, EXECUTION and STYLE. They cover many critical and

important dimensions for success:

- The Recruitment Process.

- The Onboarding Process.

- Career Training.

- Managing the Agent Contract.

- Daily Supervision.

- Digital support tools, etc.

All the above is important – BUT THERE IS NO QUICK FIX.

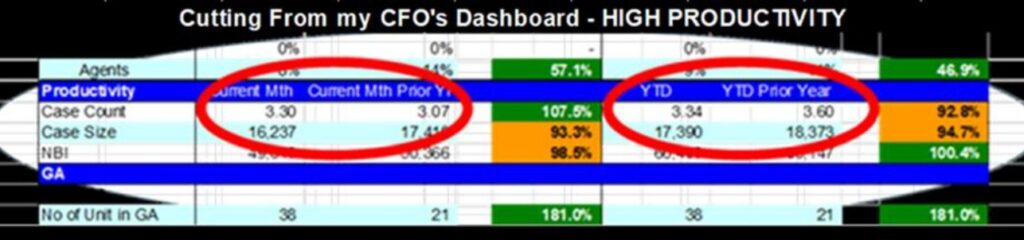

Can Agents in Thailand be more productive. Yes. Of course. In a company I led in Thailand

many years ago we hit these numbers:

Not the 4 cases per month but close and almost 7 times the Industry Average at the

time. IT CAN BE DONE – MY TEAM DID IT.

If you have “improved” all the dimensions mentioned earlier and things are still not

changing what is the MISSING INGREDIENT FOR SUCCESS?

Key Ingredient is YOU with DAILY SELF DISCIPLINE with the RIGHT STYLE.

I will address these challenges DIRECTLY at the RCEOs, CEOs and CAOs – it is

PERSONAL and it is ABOUT YOU.

- STOP DELUDING YOURSELF WITH SHORT-TERM improvements. Real

improvement take time – it does not happen over night. You are trying to change

HABITs (YOURS and your WHOLE Agency Team), and HABITS take time to form. - It is YOUR DAILY SELF DISCIPLINES that reinforce ideas with OTHERS. Your

“WE” style of Leadership interacting with Agents DAILY. Encouraging the whole

Agency Team to focus on helping the Agents to gather new Prospects every day,

call prospects to make Appointments every day, to meet Customers every day,

undertake fact finding with Customers every day, presenting personalized

solutions every day. Closing Customers every day, providing after sales service

every day. - It STARTS AT THE TOP. If your Agencies are not performing ask yourself if you

delivered your daily “triggers” with Agency today. Reviewing performance overall and

by individual Agents with the CAO every day. Agreeing what each of you will do

TODAY. Push yourself to Contact Agents and Managers every day asking how they

will help their Customers and Agents TODAY. - Then the HARD PART – REPEAT, REPEAT, REPEAT. Yes, you must do it every

day WITHOUTFAIL.

GOOD HABITS take time to learn but they can be turned into BAD HABITS so quickly

if YOU do not repeat them EVERY DAY.

Sorry RCEOs, CEOs, and CAOs if the case productivity of your team is not changing

-YOU ARE THE FAULT – NOT OTHERS. IT START WITH YOU EACH DAY.

So, stop prevaricating, finding excuses, or simply saying it is all right when it is not.

- Customers deserve full Financial Planning support from their trusted Agent.

- Agents deserve to be able to provide food on the table for their families.

I remind myself of modern vernacular my Granddaughters have taught me – “GET REAL

GRANDDAD JUST DO IT.” Whatever it was they were giving me feedback about!

All the above is not new – it is the difference between success and failure in Agency since

my early days 55 years ago. It starts and ends with you the Leader.

Credit : Mike Plaxton – January 6, 2026

This article is part of an ongoing series by Michael Plaxton examining leadership habits, productivity, and distribution effectiveness in Thailand’s life insurance industry.

We invite CEOs, RCEOs, and distribution leaders to reflect on these perspectives and join the conversation by sharing their insights and experiences.

Written : Michael Plaxton

Independent consultant.

Former CEO of FWD Thailand, former CEO of Krungthai-AXA Life Insurance.

This is a Money Playschool x Michael Plaxton collaboration. Find the original article here.

![Private: [ID: -A32lnHuAho] Youtube Automatic](https://images.moneyplayschool.com/uploads/2026/01/29190005/private-id-a32lnhuaho-youtube-au-60x60.jpg)

![Private: [ID: McQC5LDUf-Y] Youtube Automatic](https://images.moneyplayschool.com/uploads/2025/11/28130005/private-id-mcqc5lduf-y-youtube-a-236x133.jpg)

![Private: [ID: Vfw0yOvrZME] Youtube Automatic](https://images.moneyplayschool.com/uploads/2025/11/26130004/private-id-vfw0yovrzme-youtube-a-236x133.jpg)

![Private: [ID: 8XAsbpQoN2Q] Youtube Automatic](https://images.moneyplayschool.com/uploads/2025/11/24170005/private-id-8xasbpqon2q-youtube-a-236x133.jpg)

![[ID: cV6OMHk6aoI] Youtube Automatic](https://images.moneyplayschool.com/uploads/2025/11/14173322/id-cv6omhk6aoi-youtube-automatic-236x133.jpg)

![[ID: cf79IqBQh9o] Youtube Automatic](https://images.moneyplayschool.com/uploads/2023/08/16093152/id-cf79iqbqh9o-youtube-automatic-236x133.jpg)

![[ID: t6Y_Qtfg-zk] Youtube Automatic](https://images.moneyplayschool.com/uploads/2022/08/06215708/id-t6yqtfg-zk-youtube-automatic-236x133.jpg)